Introduction

Russia’s invasion of Ukraine has significantly depleted the defense stockpiles of NATO and allied countries, as governments have provided weapons, ammunition, gear, and vehicles as aid to the Ukrainian armed forces. The nature of warfare has also evolved, with relatively inexpensive drones capable of destroying multimillion-dollar equipment, leading to a new emphasis on optronics and targeting systems to address the "target-rich" environment of the Ukraine-Russia conflict.

Even if peace were brokered today—a scenario that seems increasingly unlikely given Ukraine's strong resistance and Putin’s unwillingness to yield back resource rich territory—NATO and allied countries would still need to replenish their stockpiles. Furthermore, they must ensure that their military strength is formidable enough to prevent such a situation from occurring again. Peace may be achieved through diplomacy and signatures, but it is maintained by possessing a bigger stick and superior rock throwing abilities than your opponents.

The fact is that defense departments across Europe and NATO are increasing military spending (5.2% annually until 2027) and are modernizing their armed forces with better equipment, as the number of soldiers has been reducing over the past 20 years.

A beneficiary of this increased military spending in Europe is Theon International (€728m EV), a Cyprus-based company listed on Euronext Amsterdam in February 2024. Theon specializes in night vision goggles (NVGs) and thermal imaging, enabling warfare at night for soldiers and (unarmed) vehicles.

With 170.000 active NVGs across 70 countries, including 15 NATO countries, and a soft backlog of €427m as of June 30, 2024, equivalent to 1.3x FY24 revenue, I believe Theon is well positioned to expand sales, further capturing share in a €3.2b, 11.5% CAGR market, with high returns on capital for shareholders.

Product & Market

Theon’s sales are for >90% in the night vision segment. These products make it easier to run military operations during the night - whether you are a soldier or steering uncrewed drones and other vehicles. Typically a nation’s government would purchase the NVGs for soldiers. For platform based sales, Theon acts as a subcontractor.

Deliveries are always customized to ensure that the NVGs integrate seamlessly with soldier systems, various platforms, and any specific operational requirements. With approximately one-third of the staff dedicated to R&D, their focus on meeting customer needs has driven revenue growth of 40-70% year-over-year for the past five years, resulting in a total of 170,000 active NVGs in use.

NATO countries collectively have approximately 3 million ground forces personnel, highlighting significant potential for continued expansion. Further boosting Theon’s prospects is the fact that while the size of standing armies has declined over the past 20 years, defense investments have increased. Take France, for example: in the early 2000s, its armed forces numbered around 350,000, whereas today they stand at 208,000. Meanwhile, defense budgets have surged from €34 billion in the 2000s to a projected total of €413 billion for the period 2024-2030.

This trend reflects rapidly increasing investments per soldier, signaling a broader modernization of armed forces. Quality over quantity.

Currently, Theon holds an estimated market share of over 50% in Europe, has secured significant contracts with the USMC, and is steadily expanding its presence in the MENA region.

Undoubtedly, Theon’s growth has been significantly driven by increased defense spending due to the Ukraine-Russia conflict. A key question moving forward is whether this high growth and strong margins can be sustained over the next 3-5 years.

Operating within the specialized night vision market, Theon benefits from a robust competitive moat, supported by long-term government contracts and a proven track record of reliable delivery. Given these factors, I believe Theon is well-positioned to maintain its high operating margins and strong Return on Invested Capital (ROIC).

In terms of top-line revenue growth, even just aligning with the 11.5% CAGR of the addressable market should generate substantial value for shareholders through both value creation and attractive dividend yields (40% of net income paid out FY23)

Further evidence to keep high revenues and margins is found in their Q1 high level backlog:

With a soft backlog of €502 million and an additional €586 million in customer-exercisable options (essentially unsigned proposed deals), it’s clear that demand remains robust. To put this into perspective, LTM revenue stood at €267 million. If the entire €1,088 million backlog were converted into revenue over the next three years, this would translate to an impressive 24% CAGR.

When it comes to product innovation, Theon continues to push boundaries. At the recent EUROSATORY in Paris the company unveiled its cutting-edge A.R.M.E.D. (Augmented Reality Modular Ecosystem of Devices) system, specifically designed to address the modern soldier’s need for enhanced situational awareness, real-time data, and connectivity.

It’s like a Google glass for soldiers: vital information such as friend-or-foe identification and geo-location details are displayed directly within the user’s field of view. The Group has already secured its first orders for these innovative products, which have been assigned NATO stock numbers.

Competitive advantage & moat

Theon’s competitive advantage is built around several key factors that create high barriers to entry in the night vision market:

Government contracts require longstanding relationships with defense agencies and an impeccable track record of (custom) deliveries, which Theon has.

The expertise needed to design and deliver NVG’s is highly specialized and Theon has 1/3 of it’s workforce dedicated to R&D

Building an EU-centric NVG supply chain is difficult as they depend on highly specialized and custom parts. Theon is now bearing the fruits of it’s initial high investments into securing parts of their supply chain, resulting in a capital light business: capex of €10-12m annually, compared to revenues of €330-350m

As far as competitors go, their prime competitor is the French defense & public infrastructure contractor Thales (EV €34b), having 110k NVGs in service. Thales' main advantage over Theon is its extensive experience in supplying defense agencies and governments with a wide range of products, from drones and cybersecurity solutions to naval warfare systems and railway signaling, and therefore can easily offer NVGs as add-ons. However, this breadth of offerings can also be a disadvantage. While Theon specializes in its field, allowing for tailored solutions and customization to meet specific customer needs, Thales treats the sale of night vision goggles (NVGs) as an additional component to its larger defense contracts, rather than a core focus.

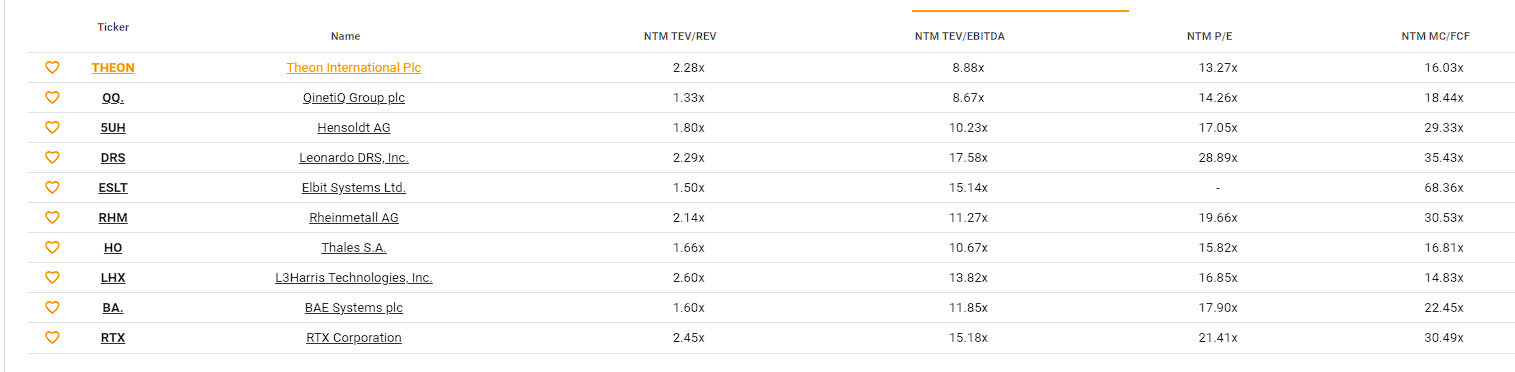

In terms of valuation we can see that Theon trades at a comparable EV/EBITDA and MC/FCF to Thales and other defense contractors. However, Theon vastly outperforms Thales in terms of ROIC (28% vs 9%), operating margins (25% vs 8%) and topline revenue growth (24% vs 4%)

Recently, Theon acquired a 60% controlling stake in Harder Digital, a specialized manufacturer of Image Intensifier Tubes (IIT) primarily operating in Germany, through a €34 million cash injection. This acquisition allows Theon to insource a critical component of the NVG value chain, as it already purchases nearly 50% of Harder Digital's output, while gaining access to more niche technologies.

Theon valued Harder Digital at €23 million, factoring in €12 million in debt and €17 million in sales, with a 10% EBITDA margin for FY24. Theon expects Harder to triple its sales by 2028, with EBITDA margins reaching the mid-twenties, driven by increasing the previously underutilized production capacity, cost savings identified by Theon's CFO, and integration into their business development efforts. These improvements make the acquisition a solid value-creation opportunity at a favorable price: Harder was acquired at a mid-single-digit EV/EBITDA, compared to Theon’s current trading multiple of 8.88x NTM EV/EBITDA in the high single digits.

With the proceeds from its IPO, Theon is looking to further expand inorganically by acquiring additional companies that are part of the NVG value chain.

Valuation

With both a dividend model based valuation and DCF model, I find Theon to be 10-40% undervalued given different 2-5y growth rates while keeping steady or declining operating margins.

Assumptions:

Risk free rate 2.18% (EUR 10y bond)

Terminal (10y+) growth rate equal to risk free rate

Growth rate declines after 5y linearly to terminal 10y rate

Terminal operating margins 15%

Cost of capital of 9.25%

NTM growth 25% (according to guidance)

NTM EBIT Margin 22% (according to guidance)

If Theon were to fully convert its existing backlog over the next three years, without securing any additional orders, this would result in an impressive 24% revenue CAGR. This sets the stage for a probable 2-5 year growth rate in the range of 15% to 20%. With EBIT margins consistently exceeding 25% over the past three years, maintaining a 20% margin over the same period is a highly achievable scenario.

Given these projections, a 15% growth rate and 20% operating margins over the next 2-5 years form a solid base case, justifying a valuation discount of approximately 32%.

Applying a dividend model, that’s based on ROE with a 5y period of dividend growth followed by a stable 2.18% growth, I get a value of €13.96, good for a discount of 28%.

When looking at peer valuation, we see a lot of similarity in terms of EV/EBITDA across defense contractors. However, Theon shows significantly better numbers for ROIC, revenue growth and operating margins, indicating it’s undervalued.

Risks

So why is my valuation showing a discount to the market price? The main reason is that the founder and current CEO Christian Hadjiminas owns approx 78% of the shares. He turned 64 years old recently and shows no signs of stopping, however he will stop sometime in the future, so when that happens there’s a lot of uncertainty regarding succession and and what he will do with his shares, given the illiquidity that comes with most small caps.

Other risks are the loss of a government contract, changes in policies or supply chain disruptions. So far Theon seems to be safe in these regards, as the trend in Europe is an increase in defense spending and Theon provides quality, custom solutions with mostly EU based suppliers.

Wrapping up

THEON is a small-cap company that hasn’t received extensive analyst coverage. Based purely on its product offering and market position, I foresee strong growth ahead and substantial value creation for shareholders.

The management has proven its ability to grow sales and maintain high margins within the highly specialized and customized defense market. This is supported by significant tailwinds, including shifts in defense spending towards quality over quantity, as well as changes in modern warfare tactics, which increasingly favor a 'target-rich' environment and nighttime operations.

According to my DCF model, there is a strong margin of safety based on cash flow projections. If the key risk of the founder/CEO not planning his succession properly is addressed, I anticipate THEON will outperform market expectations and deliver solid returns to its shareholders.

Disclaimer: This is not investment or financial advice. All information provided herein by Lowbill Research is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell any security.

I may change my views about or my investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. I may buy, sell, or otherwise alter the form or substance of any of my investments. I disclaim any obligation to notify the market of any such changes.

The material is confidential and should not be reproduced or redistributed without prior written consent from Lowbill Research. The information is current as of the date indicated and may change with market conditions. Opinions expressed are based on current conditions and may be updated or changed without notice. Due to market volatility, this information may be suitable only for certain investors. Independent investigation and consultation with qualified professionals are recommended before making investment decisions.

Why did margins increase so much vs. 2018-2020 levels? Is the current level of margin sustainable?

Why are they based in Cyprus and IPO'd in Amsterdam?

Hey Jan, I made my own post about Theon. https://mimeticinvesting.substack.com/p/while-this-company-makes-you-look And I do reference you!