Daktronics: #1 in LED displays in North America

$687m TEV small-cap leading a 23% CAGR market with a full-service offering

Introduction

If you’ve ever been to Times Square, you’ve seen a Daktronics product in action. Founded in 1968 and currently managed by CEO Reece Kurtenbach, the son of co-founder Dr. Aelred Kurtenbach, this company has risen from the challenging COVID environment to generate record revenues on a solid backlog, as it maintains its #1 position in LED displays in North America.

Starting with simple scoreboards in the 1980’s, they have developed to become the world leader at informing and entertaining audience through dynamic audio and visual communication systems.

Daktronics product & the LED market

The 2023 annual LED market reached $9.3b, with growth expected to continue on a 23% CAGR in the Americas, with Daktronics having a 45.9% market share in North America. For Live Events, their largest customer segment at 38% of revenue, they enjoy significant pricing power with nearly 30% gross profit margins, as these massive custom LED installations are not possible without Daktronics expertise.

For example, see how Daktronics delivered the HALO display in Atlanta.

Other product categories include:

Commercial LEDs (digital billboards)

High Schools / Parks & Recreation (notices and scoreboards)

Transportation (Airports, road side information)

Control Capabilities Software, which drives monthly recurring revenues as LED display owners need software to get the most out of it.

In terms of innovation, Daktronics is pioneering Flip-Chip with Chips on Board LED displays, which is a different way of mounting LEDs, giving more light for less energy, emit less heat and are more resistant to weather conditions. They’ve also delivered multiple 3D Forced Perspective displays using narrow pixel pitch displays - you might have seen those around.

As for customer satisfaction and repeat business, Daktronics sees a replacement cycle every 7 to 15 years, depending on the type. Scoreboards and big LED displays for live events last longer, while commercial advertisements get upgraded more frequently.

Supply chain issues

In earlier earnings calls it seemed like the biggest problem to solve was to deliver their products on time, as the demand significantly outpaced their ability to deliver. Early 2024 CEO Reece Kurtenbach admitted that the backlog was too large.

The drag on deliveries occurred during COVID and the supply chain disruptions of 2022-2023, leading to a slide in earnings and stock underperformance. Since then, management has done a lot of work to be able to serve customers within market lead times and has already started converting the backlog into revenue at a solid pace.

As for the locations of their supply chains, Daktronics is the only US manufacturer of scale in LED displays, with other manufacturing locations in Ireland and China.

Financial Results

With Daktronics unique expertise and full-service offering comes a strong backlog, currently sitting at $316m, down from $400m before - with LTM revenue at $818m.

With the backlog and their ability to deliver picking up, management chose to maintain profitability by hiring contractors instead of increasing their fixed SGA cost. The results are that ROIC has increased to 29% LTM vs. the sub 5% range during COVID, along with growing revenues and higher operating margins.

Since their products are considered best-in-class and are in high demand, Daktronics commands strong pricing power, leading to strong and improving operating margins. Their full-service offering and U.S. manufacturing capabilities have created a large moat when serving U.S. based customers, especially for Live Events.

Live events also account for the highest revenue per segment, as large stadiums want to improve their audiovisual capabilities to tap into concert revenue streams and more entertaining experiences. Commercial and International has been harder to compete in, as electronics giants like Samsung also operate in that space.

As for the balance sheet, we see a healthy growth in equity while maintaining significant cash reserves, leading to a net debt of -$22.59m.

It’s worth to mention that in 2023, large shareholder Alta Fox Capital Management called for the replacement of the CEO and CFO, which was at the absolute bottom of price performance ($3/share). They stayed on but seem to have gotten a wake-up call, as since share price has gone up by multiples to the current $15/share.

Valuation

Having made a stellar recovery from the lows in late 2022/early 2023, Daktronics currently trades at an attractive 6.5x EV/EBITDA, one of the lowest points it has ever been, due to large increases in EBITDA.

As for peers, Daktronics competitors are mostly larger players from Asia that also make consumer televisions and so on. The Belgium company Barco and the Chinese Leyard are closest to Daktronics, as they also specialize in LCD for businesses.

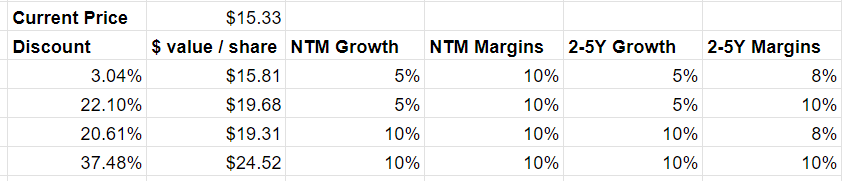

Management does not give guidance, so I made a sensitivity analysis for revenue growth and operating margins. Past year has seen a 8% revenue growth and 10.6% operating margins and I believe the operating margin can be sustained, due to the relatively fixed operating expenses and the use of contractors, priced per project.

As the business is cyclical due to workable days in the sports cycle and Live Events construction (winters have less workable days than summers and thus less product can be delivered), it makes sense to look at the business at a yearly basis rather than quarterly.

Current analyst estimates suggests 5% NTM growth in revenue and if we couple this with 10% operating margins, we see a discount of 22% vs. current share price. If we assume lower operating margins of 8% it puts Daktronics near fair value.

Conclusion

Daktronics operates in a niche market where they’ve commanded a market leading position in North America. With a LTM 29% ROIC and an industry growth of 23% CAGR, Daktronics will create value even if they merely retain their market share and operating margins.

Their biggest challenge to capturing this value, is their ability to deliver against their loaded backlog. As they have overcome the supply chain disruptions of the past and are optimizing their working capital, I believe Daktronics is well positioned to keep converting the backlog to revenue and create value for shareholders.

Further reading & research

https://investor.daktronics.com/static-files/257100da-05a9-46a8-aabb-46a6b94ce736

https://www.youtube.com/@DaktronicsInc

Disclaimer: This is not investment or financial advice. I (“Lowbill Research”) currently hold a stock position in Daktronics (DAKT) at the time of writing this article. All information provided herein by Lowbill Research is for informational purposes only and does not constitute investment advice or an offer or solicitation to buy or sell any security.

I may change my views about or my investment positions in any of the securities mentioned in this document at any time, for any reason or no reason. I may buy, sell, or otherwise alter the form or substance of any of my investments. I disclaim any obligation to notify the market of any such changes.

The material is confidential and should not be reproduced or redistributed without prior written consent from Lowbill Research. The information is current as of the date indicated and may change with market conditions. Opinions expressed are based on current conditions and may be updated or changed without notice. Due to market volatility, this information may be suitable only for certain investors. Independent investigation and consultation with qualified professionals are recommended before making investment decisions.